Financial Supervisory Authority’s priorities in 2025 remain the soundness of supervised entities’ governance and responding to uncertainties in the operating environment – summaries of inspection results to be made available on website

The geopolitical situation, changes in the operating environment and increasing regulation underline the need to monitor the risk management of supervised entities. The Financial Supervisory Authority’s priorities in 2025 will be guided by a number of different risks and their management within supervised entities: these include operational and financial preparedness, IT and cyber risks, ESG risks and risks related to outsourcing and the increasing use of artificial intelligence. Regulatory changes and emphases in supervision will focus on the soundness of corporate governance, client and investor protection and sustainability reporting. Summaries of inspections to be completed next year will be available on the Financial Supervisory Authority’s website.

Since 2023, the Financial Supervisory Authority (FIN-FSA) has published its full-year inspection and thematic assessment plan. In the future, the FIN-FSA will make summaries of inspection reports available on its website www.finanssivalvonta.fi. In this way, the FIN-FSA will support its objective, in line with its vision and strategy, to be a proactive and predictable supervisor.

“We have promoted predictability by communicating our supervisory plans so that our supervised entities know what we consider, as supervisor, to be important at any given time. In the future, we will enhance our predictability by reporting on our website key findings also for inspections of individual supervised entities, thereby providing guidance to all supervised entities,” says Tero Kurenmaa, Director General of the FIN-FSA.

The 2024 plan was implemented quite comprehensively. Some inspections were cancelled due to, among other things, changes in a supervised entity’s circumstances or a reallocation of inspection resources.

“We will continue to be ready to review our supervisory priorities flexibly throughout the year,” says Kurenmaa.

As in previous years, the FIN-FSA’s supervisory priorities in 2025 relate to operational and financial risks in an uncertain environment. In addition, supervisory priorities will be guided by new regulations and their enforcement; the Artificial Intelligence Regulation, the Digital Operational Resilience Act (DORA) and the supervision of sustainability reporting will present new areas to be supervised. The FIN-FSA will also be responsible for the supervision of new authorised supervised entities, such as crypto-asset providers and the pension provider KEVA.

Inspections and thematic assessments in the various supervisory sectors

Each year, the FIN-FSA carries out a number of inspections of individual supervised entities as well as thematic assessments of groups of supervised entities in accordance with its supervisory priorities. The priorities of European supervisors and the risk-based approach also guide the FIN-FSA’s inspections and assessments.

The priorities of the ECB’s banking supervision for 2025 focus on banks’ ability to withstand immediate macro-financial threats and severe geopolitical shocks (priority 1). Banks are also urged to remedy persistent material shortcomings in an effective and timely manner (priority 2) and to tackle emerging challenges stemming from the use of digitalisation and new technologies and properly mitigate the risks associated with them (priority 3). The supervisory priorities are based on last year’s priorities.

Of Finnish banks, Nordea, OP Financial Group, Danske Bank and Municipality Finance are under direct ECB supervision, but the FIN-FSA conducts supervision in Finland in cooperation with the ECB. Where applicable, the FIN-FSA will also follow the same priorities in the supervision of smaller credit institutions under its direct supervision.

In 2025, the FIN-FSA will focus its thematic assessments of banks on topics related to credit risk and lending. Inspections will focus on the soundness of corporate governance and the use of internal models.

In banks and payment services, the FIN-FSA’s inspections and assessments will cover themes related to the prevention of money laundering and terrorist financing as well as supervision of compliance with sanctions.

In insurance supervision, thematic assessments will focus on investment expenses, solvency calculation and valuation of assets and liabilities. The use of automated decision-making and the manner of implementation of agent activities will also be assessed. In addition, inspections will focus on the soundness and arrangement of corporate governance, issues related to outsourcing, and risk management.

Supervision of capital market participants will assess, among other things, the application of IFRS standards, sustainability reporting and the marketing of crypto-asset services. Together with the European Securities Market Authority (ESMA), an assessment will be conducted of themes related to compliance and internal control. Inspections will also focus on, among other things, cyber risk management, listed companies’ compliance with obligations, and management of the sustainability risks of fund management companies.

Thematic assessments and inspections will be reprioritised if events in the operating environment so require.

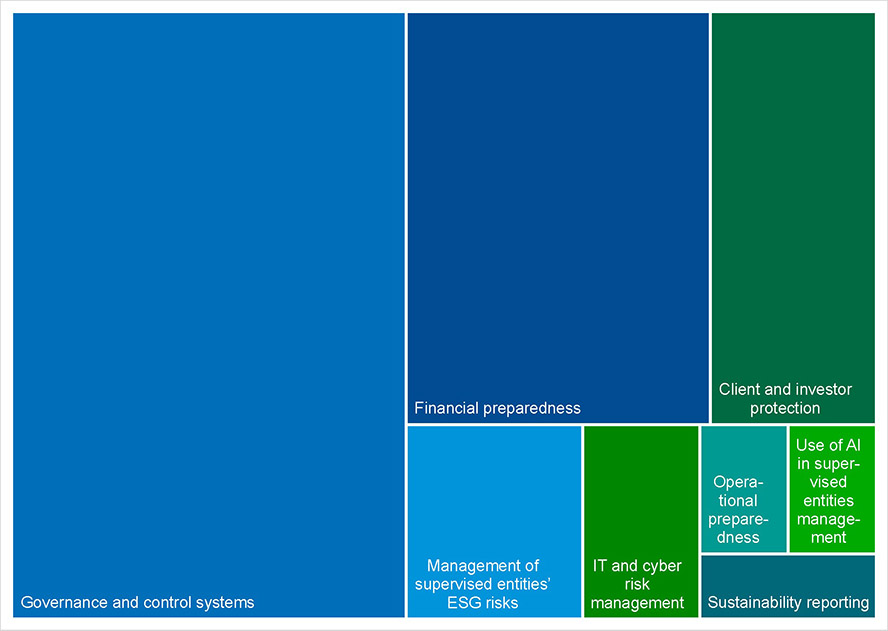

Quantitative distribution of thematic assessments and inspections in the supervisory priorities.

Summaries of inspection reports on public website

As in the past, the FIN-FSA will communicate thematic assessments directed at broader groups of supervised entities on a general level in the form of supervision or press releases. The findings of thematic assessments may lead to the launch of more detailed investigations or other supervisory measures.

In addition, the FIN-FSA will start to publish summaries of entity-specific inspections completed in 2025 on its public website. The summaries will report the key findings of the inspections and thereby provide guidance to a broader group than the subjects of the inspections themselves with regard to the topics on which the supervisor’s inspections are directed on a risk basis as well as the issues on which the supervisor is focusing in inspections related to the topics in question.

Summaries will be posted on the website only for inspections carried out at the FIN-FSA’s own initiative, in accordance with the inspection programme. Significant banks for the Eurosystem relevance are under the direct supervision of the ECB with regard to prudential supervision. The FIN-FSA cannot therefore publish anything about these inspections.

The FIN-FSA will start to post summaries on its website during the first part of the year, initially publishing several summaries at a time. The summaries will be available on the FIN-FSA’s website.

For further information, please contact:

Jyri Helenius, Deputy Director General of the FIN-FSA.

See also:

- Assessment and inspection plan 2025 (pdf)

- FIN-FSA supervision release 1 February 2024: Financial Supervisory Authority will focus in 2024 on risk resilience of supervised entities in a changing operating environment and on soundness of governance

- FIN-FSA supervision release 25 January 2023: Supervision focuses on economic uncertainty, cyber security and long-term changes in the operating environment

- European Central Bank, Banking Supervision press release 17 December 2024: ECB keeps capital requirements broadly steady for 2025, reflecting strong bank performance amid heightened geopolitical risks