5. Monitoring of securities market trading

A requirement for the functioning of the securities markets is that investors can have confidence in the markets and market participants. Market abuses, such as misuse of inside information and market manipulation, erode this confidence and are therefore prohibited by the Market Abuse Regulation (MAR). Our market surveillance team investigates suspicious transactions and possible abuses in the securities markets.

Supervision in 2024 and priorities for 2025

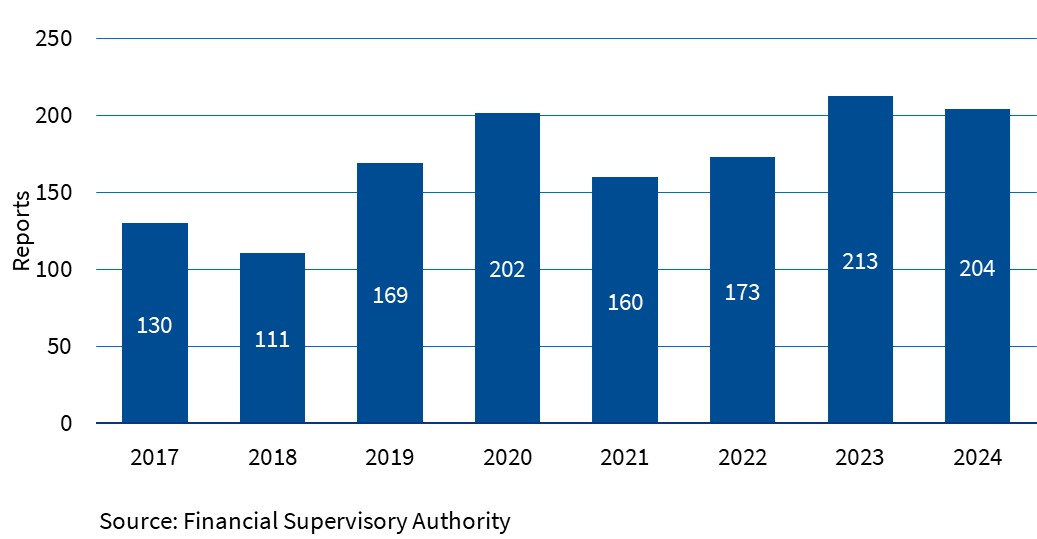

Reports of suspected market abuse

In 2024, we received a total of 204 suspicious transaction and order reports (STORs) from the market on orders and transactions that may involve insider trading or market manipulation or attempts to do so1. Reports from market operators, such as stock exchanges, made a total of 90 reports, while parties, such as banks and investment firms, that participate in receiving, mediating or executing orders involving financial instruments made a total of 114 reports. Two-thirds of the STOR reports came from Finnish entities and one-third from foreign entities, which is similar to the previous year’s level and distribution. There has been no significant change in the number of STOR reports compared with the previous year.

Figure 2. STOR reports submitted to the FIN-FSA in 2017–2024

In addition to STOR reports under the MAR, any market participant has the opportunity to submit reports of suspected infringements (so-called whistleblowing system) or informal market observations to the FIN-FSA2. In 2024, we received a total of 15 such observations or suspicions of insider trading, market manipulation or managers’ transactions. To facilitate the investigation, it is important that the report contains not only a description of the nature of the suspicion, but also as clear and comprehensive information as possible about the suspicion or suspicious event, including precise dates and other identifying information.

In addition to investigating reports of potential market abuse received from market participants, we screen and analyse trading events using our own supervisory systems and procedures.

Investigations and measures concerning suspected market abuse

In investigations, we particularly utilise transaction reporting data3 and other detailed surveillance material and, if necessary, we obtain additional information to clarify the matter or suspicion, including through requests for information and requests for assistance. In 2024, transaction reporting data on a total of around 145 million transactions was reported to the FIN-FSA’s database. High quality of the data is essential to effectively carry out the FIN-FSA’s tasks and supervisory activities. In 2025, we will pay particular attention to, among other things, the completeness and accuracy of decision-maker data in transaction reporting. The availability of telephone recordings and the proper submission of STOR reports to the FIN-FSA will also be a focus of attention. According to our observations, there is a fairly high concentration of reports from a somewhat limited number of the actors.

Detailed and extensive trading data also facilitate the use of AI in surveillance. We will continue this development work both internally and by participating in the AI projects of the European Securities and Markets Authority (ESMA) and the European Commission.

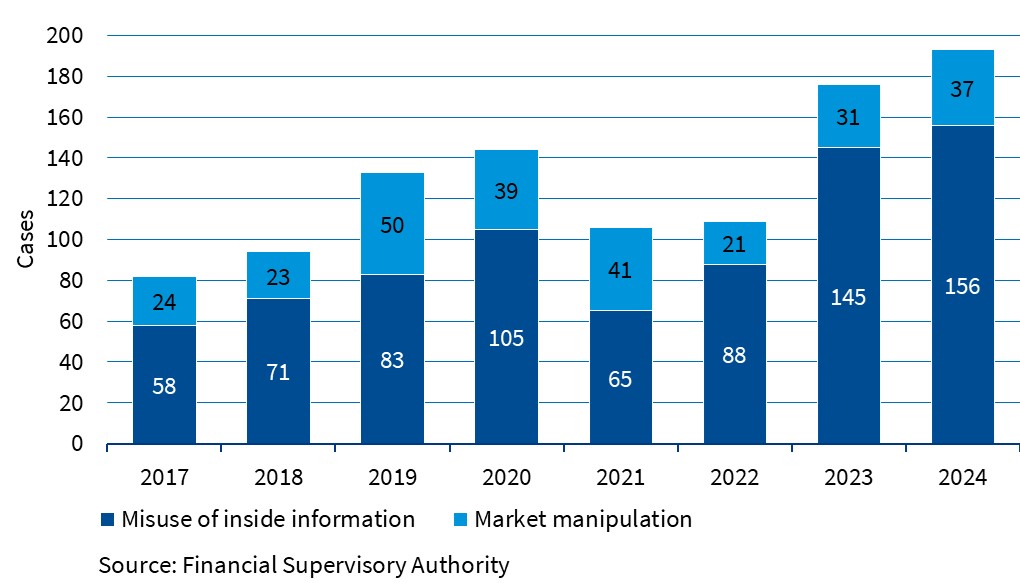

In 2024, the FIN-FSA investigated 156 supervision cases related to misuse of inside information and 37 cases related to market manipulation. The development of the number of cases investigated in these subject areas is shown in the figure below.

Figure 3. Supervision cases related to misuse of inside information and market manipulation investigated by the FIN-FSA in 2017–2024

If, at the end of an investigation, there is reason to suspect misuse of inside information, market manipulation or some other MAR violation, we intervene in the case either with administrative sanctions or by making a request for police investigation, if we have reason to suspect a crime. In 2024, we made more requests for investigation into suspected misuse of inside information and market manipulation than in previous years. We also imposed administrative sanctions on several natural persons for omissions in relation to the code of conduct provisions of the Market Abuse Regulation; in early 2024, we imposed a penalty payment on a former member of the board of a listed company for trading during a closed period and, in late 2024, a total of six penalty payments on managers of companies and other natural persons for omissions in relation to managers’ transaction notification obligations4. The increase in the number of requests for investigation and administrative sanctions has been partly due to, among other things, the emphases and risk-based approach of surveillance as well as to further development of surveillance processes and systems.

In our surveillance, we have continued to observe omissions in relation to the notification of managers’ transactions, as a result of which we will continue to focus our surveillance on this area in 2025, with a particular emphasis on listed companies’ obligation to inform managers of their regulatory obligations.

In our monitoring of market manipulation, we focused on wash trades and trading where the price of a financial instrument is repeatedly influenced by small trades or aggressively priced orders. We wrote about wash trades in, for example, Market Newsletter 2/2024, by reviewing good practices for investment service providers in the monitoring and prevention of wash trades and special trading situations. In monitoring of market manipulation, we will continue to focus our surveillance on these themes as part of our ongoing investigations.

International cooperation

We participated in an ESMA working group on market confidence and integrity. The group discusses current regulatory and supervisory issues, with a particular focus in 2024 on matters related to the implementation of the Listing Act amendments.

We carried out a bilateral exchange of supervisors with the Dutch Authority for the Financial Markets (AFM) to develop and share our expertise and best practices on market abuse investigation methods, processes, supervisory systems, data sources and data utilisation. We also continued to deepen international cooperation in abuses related to fixed income markets. In addition, we engaged in active bilateral discussions on themes of current interest, particularly with Nordic securities market supervisors. We will continue this cooperation in matters related to supervision, regulation and investigation of suspicious activity in the future.

Regulatory changes

The amendments to the Market Abuse Regulation under the Listing Act that came into force in December 2024 contributed to lightening the obligations of issuers and managers. The FIN-FSA decided that in Finland the threshold for the notification of transactions by persons discharging managerial responsibilities in an issuer will be EUR 20 000 (previously EUR 5 000), in line with the Regulation. Trading permitted for managers during the closed period was extended also to include bonus, share and savings schemes involving financial instruments other than shares, and transactions not involving active investment decisions by managers (including inheritances, gifts). The task of reporting transactions in own shares to the authorities of other trading venues was transferred from issuers to supervisory authorities. In market sounding, so-called safe harbour regulations were adopted. Compliance with market sounding procedures became optional for market participants disclosing information, but compliance with the procedures will continue to provide protection against unlawful disclosure of inside information. These topics were also covered at last year’s events for listed companies (presentation material, in Finnish).

Market abuse provisions on crypto-assets

The provisions of the EU Markets in Crypto-Assets Regulation (MiCA) preventing and prohibiting market abuse began to be applied on 30 December 2024. The provisions concern crypto-assets that are admitted to trading or in respect of which a request for admission to trading has been made. The provisions prohibit insider dealing, unlawful disclosure of inside information and market manipulation related to crypto-assets.

Under MICA, natural and legal persons professionally arranging or executing transactions in crypto-assets are obliged to report to the competent authority all reasonable suspicions regarding an order or transaction, including any cancellation or modification thereof, and other aspects of the functioning of the distributed ledger technology such as the consensus mechanism, where there might exist circumstances indicating that market abuse has been committed, is being committed or is likely to be committed.

Crypto-asset issuers, offerors and persons seeking admission to trading shall inform the public as soon as possible of inside information that directly concerns them, in a manner that enables fast access as well as complete, correct and timely assessment of the information by the public.

More detailed procedural guidelines on the disclosure of inside information and the obligation to report market abuse will be provided in the Commission’s Level 2 Implementing Regulations. The FIN-FSA has published on its website guidance for crypto-asset activities on the disclosure and delaying the disclosure of inside information and on the reporting obligation concerning the prevention and detection of market abuse. The website will be supplemented after the adoption of the Commission’s Level 2 Regulations.

For further information, please contact:

- Monitoring of securities market trading: Hermanni Teräväinen, Chief Supervisor, hermanni.teravainen(at)fiva.fi or tel. +358 9 183 5346

- Sari Helminen, Head of Division, sari.helminen(at)fiva.fi or tel. +358 9 183 5264

1 Reporting obligation concerning the prevention and detection of market abuse - Issuers and investors - www.finanssivalvonta.fi

2 Report suspected infringement - About us - www.finanssivalvonta.fi

3 Transaction reporting - Reporting - www.finanssivalvonta.fi

4 Penalty payments to three companies for late notification of managers’ transaction - 2024 - www.finanssivalvonta.fi and Penalty payments to three natural persons for late notification deadlines of managers’ transaction - 2024 - www.finanssivalvonta.fi